[et_pb_section fb_built="1" admin_label="Section" module_class="artical-insights-single custom_li_sec" _builder_version="3.22.3" collapsed="off"][et_pb_row admin_label="Row" _builder_version="3.22.3" max_width="600px" use_custom_width="on" custom_width_px="600px"][et_pb_column type="4_4" _builder_version="3.0.47"][et_pb_text admin_label="Text" _builder_version="3.19.14"]

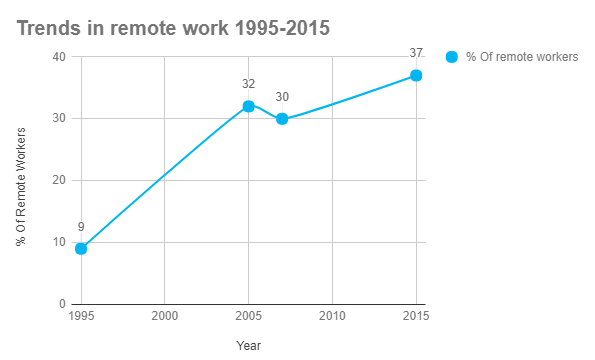

With the unemployment rate hovering at 3.8% and increasing competition, it can be difficult for companies to recruit top talent. Luckily, hiring is no longer limited to workers in the immediate area. Companies can hire remote workers all across the globe. In addition to widening the talent pool, remote work increases productivity and lowers employee attrition.

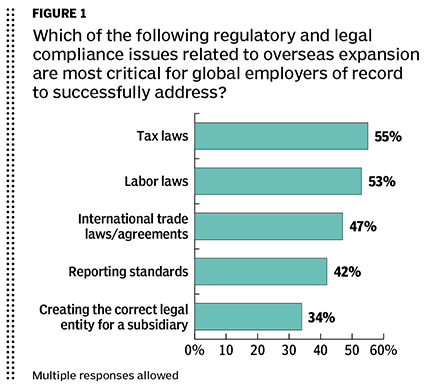

However, having workers outside of the state or country where your business operates also creates some challenges. In a new survey of senior finance executives in the U.S., over half of participants stated that different HR, legal and tax compliance regulations have kept them from implementing their international hiring strategies.

But with all the benefits that remote work can have for both employers and employees, it is important not to let these obstacles stop you from hiring remote talent. Instead, take the time to familiarize yourself with state, federal and international regulations so you can move ahead compliantly.

Employment status

There are several different types of employment status that can be used when hiring remote workers and each of them carries different HR and legal consequences.

- Direct employee: Your company hires an employee directly and is generally responsible for tax, social contributions and other legal requirements. Each time you hire a worker in a new state, the burden of compliance rests solely with you.

- Self-employed/freelance/contractor: The worker is generally responsible for their own tax and social contributions. This frees your company from much of the compliance issues, but it also creates a different type of working relationship with the employee.

- Third party: Your company uses a third party to employ remote workers and the tax and social contributions are taken care of by the third party. This is sometimes referred to as a co-employment model.

Many companies use a combination of the three models. For example, they might employ remote workers in a different state directly, but only hire contractors abroad.

Tax and social contributions

Regulations around taxation and social contributions (social security, healthcare, disability, etc.) differ from state to state, even more so between different countries. The way these are handled comes down to the employment status of the remote worker.

Here are the general rules for remote employees in the US:

- If a remote worker is employed directly by your company, then you will be responsible for most tax and social contributions.

- Remote employees must pay taxes in the state where they live regardless of the business’ location. This is referred to as the physical presence rule.

- The employer must pay taxes on the wages for those employees to the state where the employee lives, even if the company has no physical presence in that state.

- The employer must offer social contributions in accordance with the laws of the state where the employee lives, not where the company is located.

Companies should register with the appropriate tax agencies in each state where at least one employee is working. There are exceptions to every rule, however, so it’s important to seek detailed advice from your tax advisors regarding laws for individual states.

For international remote employees:

- For direct employees: Both the state in which the company is located and the employee’s home country will be looking for taxes and social contributions to be paid. To avoid double taxation, it’s best to look into tax treaties between the two countries to understand credits and exemptions which may be applied.

- For contractors: The employee is responsible for paying taxes and social security appropriately. In these cases, companies tend to provide a stipend for accounting services to help support and clarify what the employee needs to pay.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row custom_margin="||30px|" padding_top_1="40px" padding_bottom_1="40px" module_class="book-demo-wrapper download-report-sec et_pb_row_fullwidth" _builder_version="3.22.3" background_color="#00b3e3" width="89%" width_tablet="80%" width_last_edited="on|desktop" max_width="89%" max_width_tablet="80%" max_width_last_edited="on|desktop" module_alignment="center" make_fullwidth="on"][et_pb_column type="4_4" _builder_version="3.0.47"][et_pb_text admin_label="Download Report Section" _builder_version="3.19.14" text_orientation="center"]

Report Download:

How Netflix Navigated the Recession

[contact-form-7 id="3793" title="Netflix Recession"]

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row _builder_version="3.22.3" max_width="600px" use_custom_width="on" custom_width_px="600px"][et_pb_column type="4_4" _builder_version="3.0.47"][et_pb_text _builder_version="3.19.14"]

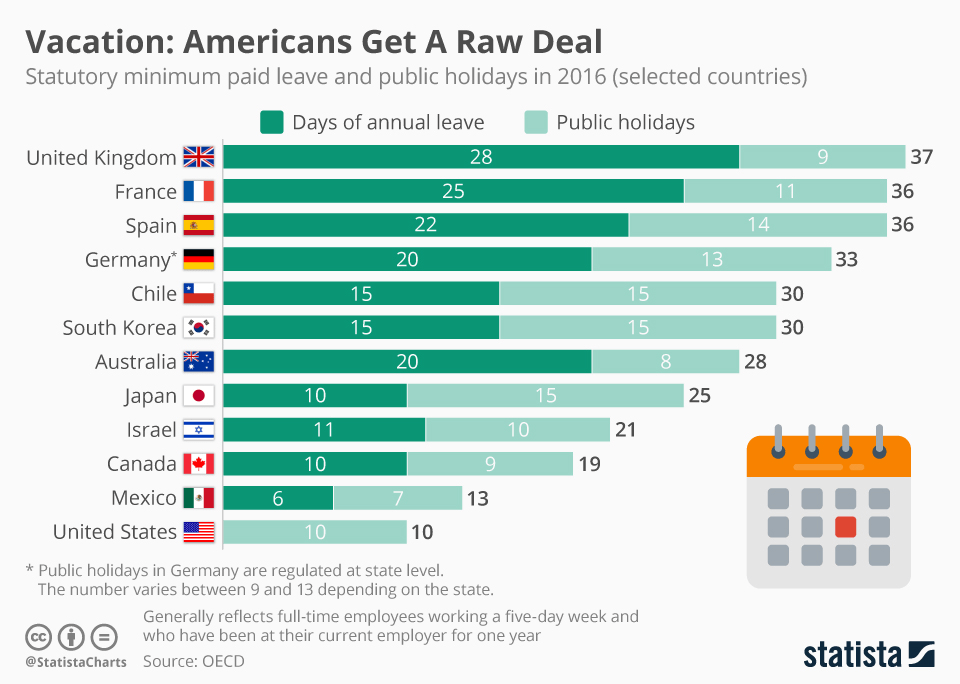

Vacation

There is no federal or state mandate regarding vacation time in the US. However, once vacation days are offered, companies must adhere to state laws regarding vacation, if those exist. For example:

- State labor and employment statutes may restrict vacation offers.

- Some states forbid “use-it-or-lose-it” vacation policies, so an employee’s accrued vacation time will not expire.

- State laws vary regarding whether accrued, unused vacation must be paid on termination of employment

Similar to taxation, the state mandates apply to the state the remote worker is located in, not the state where your company is located.

Most other industrialized countries have mandated vacation time, including paid, unpaid and holidays. If your remote workers are employed directly by your company, then you’ll need to abide by these policies.

Data security

According to Accenture, there were over 130 large scale cyber-attacks in the US, and that number is growing 27% per year.

Adding remote employees to your workforce can increase potential weak spots to your network endpoints, opening up the potential for cyber-attacks. Because many remote workers use public spaces and wi-fi for work, there can be an accidental disclosure of data that exposes your company to unwanted vulnerabilities. Thus, it is crucial to establish strong security policies and guidelines to prevent data loss.

In addition, it is necessary to understand laws regarding cross-border data transfers, such as GDPR, and the implications of sharing information about customers globally.

Outsourcing the complexity

Staying on top of these regulations and remaining compliant can seem overwhelming—but it can be done. For some businesses, however, it might make sense to outsource these operations to a third party provider.

Professional Employer Organizations (PEO), for example, partner with small businesses to provide payroll, benefits and HR support for workers across the U.S. They use a co-employment model where your employees legally appear on the PEO’s books for tax and compliance purposes. As your company hires remote workers in different states, this can help you save time on routine administrative tasks.

An Employer of Record (EOR) offers a similar model for international employees. An EOR will ensure that you are compliance by navigating foreign employment regulations on your behalf.

Your employees are your most valuable resource. It makes sense to hire the best workers no matter where they’re located, even if this means putting a little extra time and effort into your compensation and benefits program.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

.webp)

.png)

.png)